How to Raise Financially Responsible Children

W hy should you start looking into how to raise financially responsible children while they’re still young?

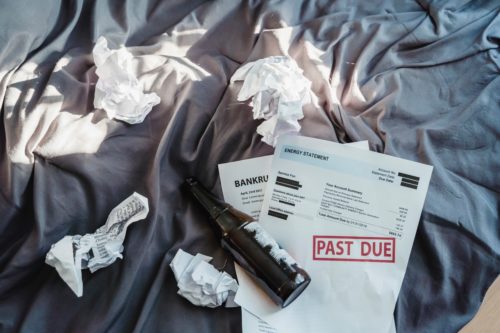

The upbringing of your kids plays a vital role in their performance in later life when they would be responsible for carrying their own family expenses. A lack of a financially conscious mentality in your children might get them into huge debts, unjustified means of earnings, and possible threats to life which would ultimately hold an adverse effect on your old age. Not to worry and not to fret as we have come up with 8 effective tips on how to teach your children financial responsibility to shape them into money savvy adults.

1. Pocket Money System

Monthly pocket money would first and foremost establish boundaries for your child. Your kid would be bound to save and spend money in accordance with his or her pocket money budget. This would primarily cut off any extravagant nature formation in your child.

2. Design Your Kid’s Expense List and Savings Plan

If your child faces problems in spending and saving their pocket money, be their guide. Enlist in front of them their mandatory expenses and extra wishes and teach them how to complete their list by the end of the month together with saving some amount in the end.

3. Observation

A parent’s duty doesn’t end at specifying pocket money and designing a saving and spending plan. A steady observation shall be kept by parents on their children’s activities and their spending. Problems arising from any unacceptable extra expenditure or undesirable peer group shall be instantly addressed by parents. This would not only contribute to the sense of financial responsibility in children, but also keep them away from getting involved in bad habits that could cost them extra expenses on a life-long basis.

4. Accountancy

An essential part of parenting is holding your child responsible for their expenditure patterns. This would allow you to keep a track of and control the expenditure habits of your child and would abstain your kid from unnecessary spending which couldn’t be justified in front of his or her parents. Together with our previous tip of observation, accountancy also counters the extravagant habits of children at the early stages of formation.

5. Penny Bank

You can give your child a cute little penny bank or money box. This would encourage them to save daily some amount of money in their money box. In the long run, the little habits of savings in the early stages of life tend to contribute to a financially responsible mentality of a person as an adult.

6. Bank Account

Apart from saving schemes at home, you can also seek aid from financial institutions. A number of banks in several countries offer amazing schemes of young savers’ accounts. These schemes allow your children to open their bank account at a minimum amount. In this way, you can teach your children the benefits of savings and the banking system and your child could even enjoy the merits of multiplied savings. The habit of saving together with the knowledge of the banking system provides a solid base for a sense of financial responsibility in your child.

7. Target System

Setting out a target system further enhances the pocket money system in your house. Let any major wish of your child, a smartphone, PlayStation, or the latest in the Grand Theft Auto Series be a target for your child. Encourage them to save a specific amount from their pocket money solely for their targeted wish so that they can achieve their target after a specific period of time. The tip brings your child on a major route to being financially responsible in the future where he will finally be able to carry his own expenses and even save some amount afterwards.

8. Open-Ended Conversation with Your Child

Having an open-ended conversation with your child is a crucial part of good parenting. An open-ended conversation will allow you to know about the wishes and worries of your child and propose ways in which they can manage their expenses to solve these problems. Your child should be aware of the reasons due to which you refuse them from certain expenditures. More than that, children will be well-aware of the financial income limitations and schedules in their house so that they can feel financially responsible in the same way you do.

Having children who are well-aware of their financial circumstances and act responsible towards it is no less than a blessing. Our tips on How to Raise Financially Responsible Children might not be foolproof in achieving our main objectives however these tips remain essential in establishing roots for financial responsibility in your child at a young age.